Learning Zone

Reduce your fleet insurance cost with these 5 tips

Reduce your fleet insurance costs

Wondering how? We share out five top tips

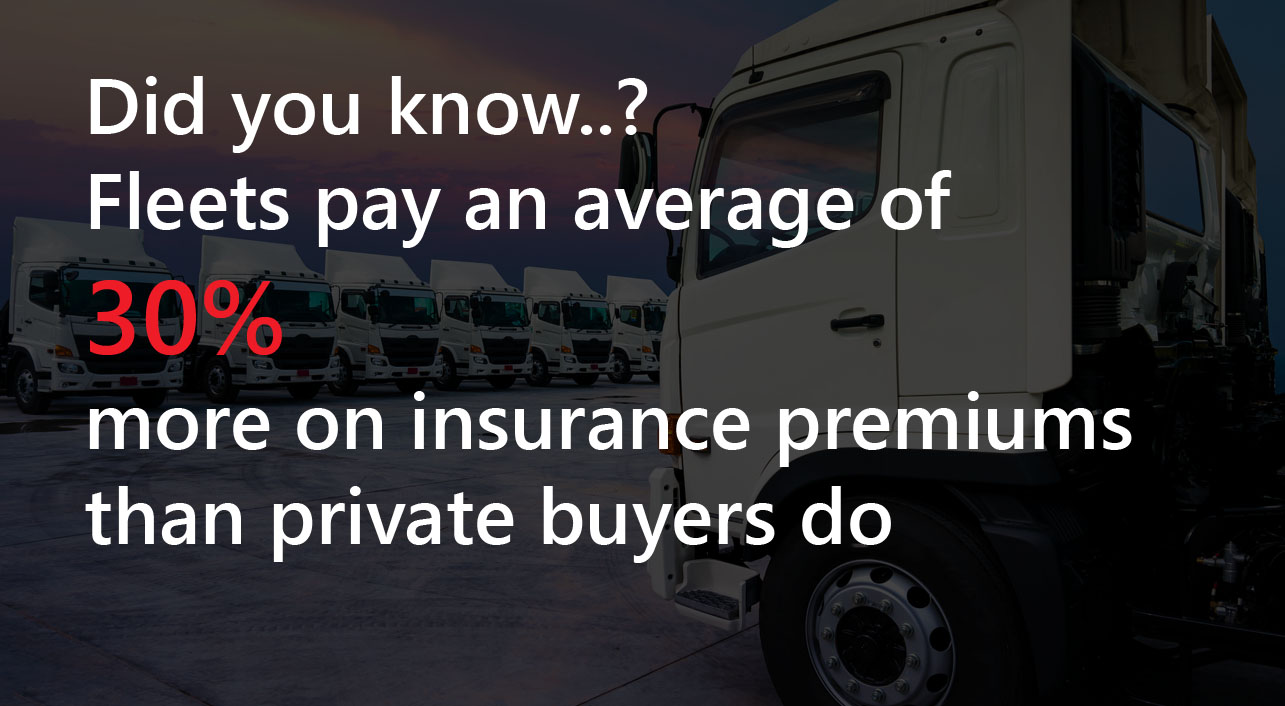

With costs on the rise, insurance is an expense that fleet managers simply can’t avoid. Claims costs, for example, often account for a substantial percentage of fleet insurance and by reducing accident rates, is one of the most effective ways of driving down premiums.

Easier said than done?

These five tips can be used to control insurance rate hikes and improve your fleet safety:

1. Carry out regular assessments

The first step in driving down fleet insurance costs is to look at the stats. Data is your friend, so ensure that you have plenty of relevant, accurate information to hand to make risk assessments.

Talk to your insurer for their viewpoint on your accident history. They may be able to benchmark your fleet accident rate against similar operations to determine how you compare.

Utilize your own information and compile reports about the kind of incidents that have taken place, the factors that caused them and if any common issues can be identified.

And don’t just look to the past. Ensure that you are recording all comprehensive information about incidents that take place on your fleet, and not just those that require claims.

2. Enforce minimum standards for driving

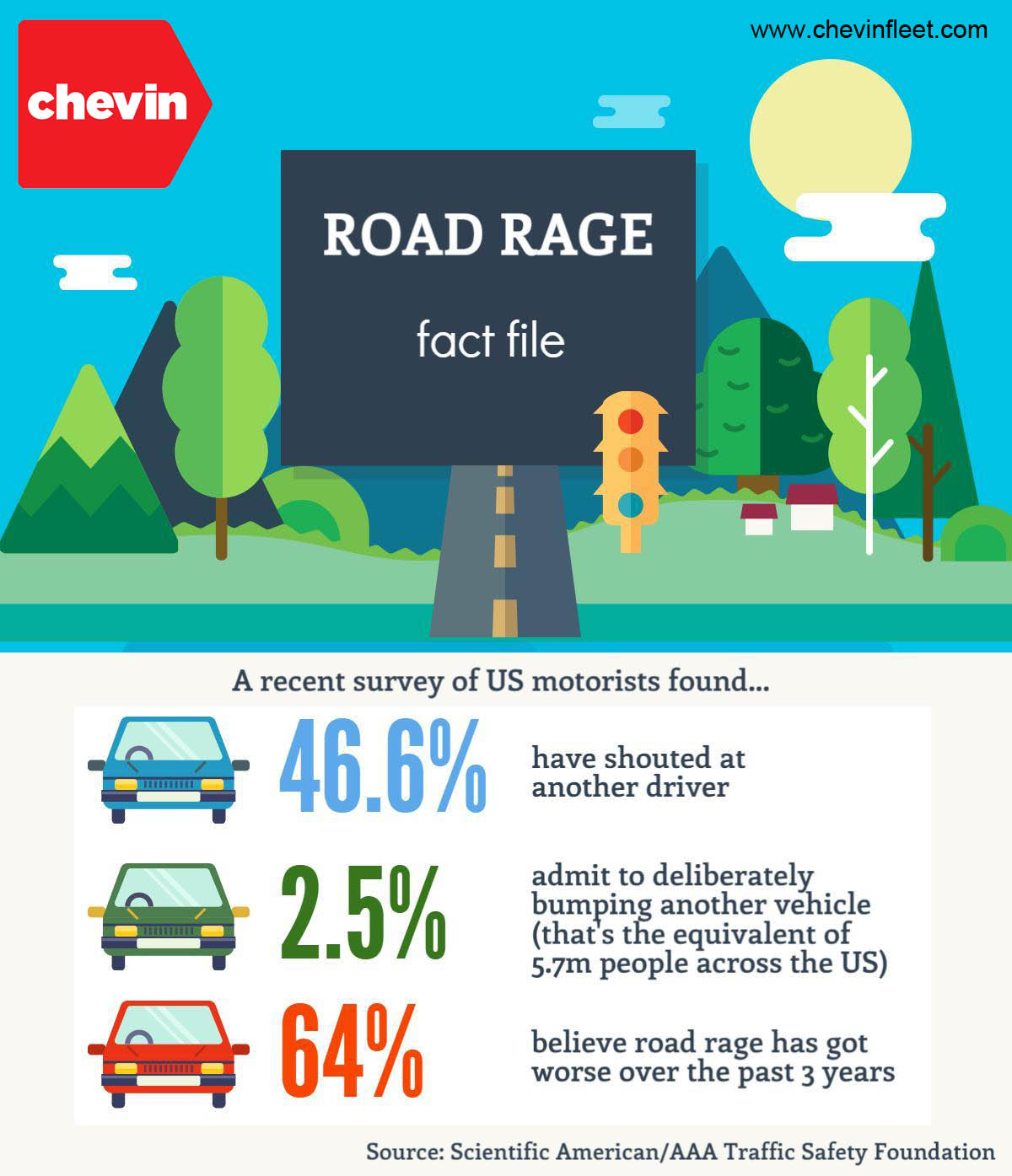

Good drivers cause fewer accidents – and that, of course, leads to lower premiums.

As part of your duty of care, you should already have extensive risk management measures in place that includes your drivers. These should include regular driving license checks to ensure that drivers have disclosed any convictions. Take note of higher potential risks such as those covering higher than average mileage and young drivers.

Here, you are essentially trying to identify individuals and/or groups that are heightening your accident rate. Review all available data and try to spot useful patterns. Fleet management software can be one useful way to pull such data together and compile trend reports.

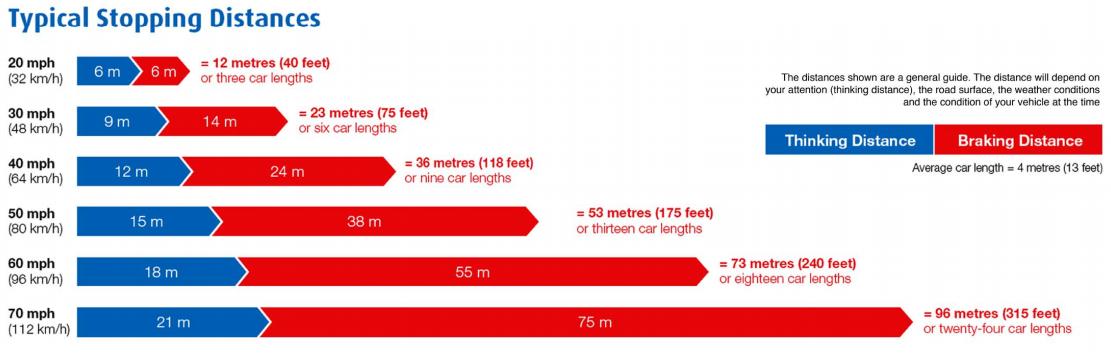

Consider improving your drivers’ road skills by engaging them on safety. These may require additional, specific training or increase visible awareness of accident reduction and driver safety tips.

3. Target drivers who don’t meet your standards

So, you’ve carried out the first two tips and identified those drivers who don’t meet your minimum standards or who appear to be have a higher accident rate. The next question is – what should you do about them?

Adding just a single driver with a poor history to your fleet auto insurance can raise premiums by more than 10%.

Consider adopting a policy of escalating measures to encourage safety on the road. These could include measures such as online fleet driver safety training or even in-car tuition tactics.

Drivers with a greater number of points on their license will need close monitoring to minimize the risk of additional penalties which could move them into a higher risk insurance category.

4. Monitor through software technology

There is a range of supporting technology available to hat can help to improve your accident rate, which will help in reducing your fleet insurance cost.

On-board vehicle telematics and dashboard cams can evidence how your vehicles are being used in the real world. They provide data evidencing which drivers are most likely to speed regularly and brake suddenly, for example, and even help to establish who was at fault in an accident.

Outside the vehicle, fleet information management systems provide a comprehensive solution that can enable you to gather information and analyze it in a thorough and useful manner, creating relevant reports for both you and your insurer.

5. Review before renewing

The benefits of all your work will start to become apparent when you can illustrate that you are driving down your accident rate.

Before you renew your fleet insurance, take the time to gather the relevant information to demonstrate your fleet safety management plans and show the strides you are making and ensure that you are keeping an ongoing dialogue in place with your insurer. As always, fleet management software is a great asset in efficiently achieving this.

Good luck!