Learning Zone

The importance of tracking fleet accident statistics

Improve your fleet operations by tracking vehicle accident statistics

The results can be utilized to understand areas of concern and help develop methods of improving safety

According to the Bureau of Labor Statistics (BLS) within the U.S Department of Labor, around 40% of motor vehicle accidents are work-related. Released in December 2018, a BLS report – National Census of Fatal Occupational Injuries in 2017 – indicates that driver/sales workers and truck drivers had the largest number of fatal occupational injuries.

Data from the U.S Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) is also worthwhile tracking. A report by NHTSA’s National Center for Statistics and Analysis (NCSA) noted that fatalities in crashes involving large trucks increased by 9% from 2016 to 2017. In addition, NCSA noted that over a ten-year period there was a 12% increase in the total number of people killed in large truck crashes, including occupants of other vehicles and trucks, as well as pedestrians.

It’s worth noting that any data indicating higher accident rates for fleets doesn’t always account for the number of miles driven per year in business vehicles. For example, while a typical non-fleet driver in the U.S travels 12,000 to 15,000 miles annually, most fleet drivers travel 20,000 to 25,000 miles or more each year on company business, and therefore have a greater exposure to crash risk.

What is the cost to fleets?

For fleets, that significant risk to employees who drive for their jobs is compounded by the high cost of fleet vehicle accidents. Among the most expensive claims for businesses, the average cost of a loss related to a fleet vehicle accident is approximately twice the cost of an average workplace injury.

And, along with vehicle and other property damage, those crashes cause a loss of productivity and revenue, expose a company to liability claims when their employee is at fault, and for self-insured operations have direct costs.

In its 2018 Driver Safety Risk report, reimbursement platform provider Motus elaborates on accident frequency and costs. As an example, 68% of companies in the report had recent on-the-job accidents within the company. Furthermore, such vehicle accidents cost employers over $56 billion in 2017. The report also found that U.S collision insurance claims remained at the highest levels over the past ten years, with a steady increase over the past five years.

Implementing driver safety programs

Concern for company personnel and other motorists, liability exposure and accident-related costs all drive up the need for more focused safety efforts amongst fleets. However, the Motus report also indicated that only 42.6% of companies mandated driver safety programs for employees in company-owned vehicles, with just 19.5% requiring them for employees in mileage reimbursement programs.

Still, Motus added that companies could reduce accident rates by as much as 35% if they expanded their driver risk management approach. By taking proactive steps to reduce incidents among their mobile workforces, companies that are working on finding ways to avoid preventable accidents are employing several programs and approaches that do work.

Measures that a fleet manager can take are a combination of programs, policies and technology including:

Implementing training. This is to promote safe driving behaviors and address issues such as speeding and hard braking. Driver training programs can also be used to counter negligence claims made during accident litigation.

Adopting vehicle safety technologies. These include optional systems for an additional cost. Currently, vehicle manufacturers are making safety technology previously found only on upscale models available on typical fleet vehicles.

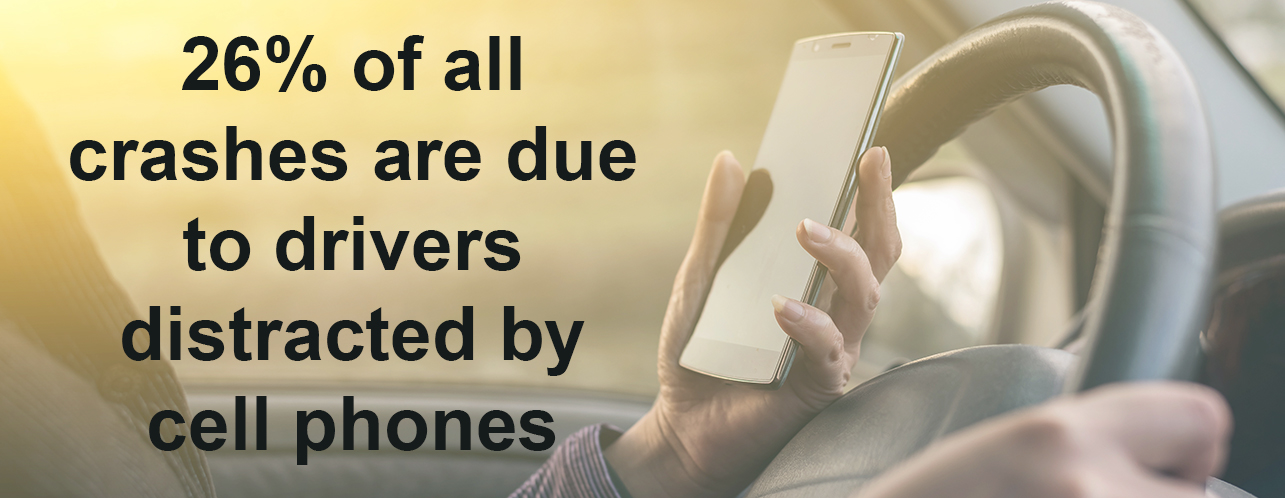

Establishing and communicating written safety policies. These need to set clear and consistent expectations that are backed by the enforcement of established consequences of non-compliance. One common policy, for example, covers the use of mobile devices whilst operating company owned, leased or personal vehicles on company business – the National Safety Council reports that 26% of all crashes involve cell phones.

Using a comprehensive management solution

Approaches to management can be implemented and supported through an increased level of visibility into safety data on drivers by the employment of fleet accident management software. As part of a comprehensive fleet and asset enterprise management solution, such software helps ensure that driver policy meets with your fleet’s compliance requirements.

It can analyze potential risk by providing:

Up-to-date, organized and easily accessible driver records in a central repository. A system of alerts and reminders can be created for pending, due or past due renewable deadlines.

A fully auditable accident management package. This covers road risk policies, incident reporting, repair details for insurance claims and communications with third parties and other agencies.

Improving fleet safety may be complex, but it’s too costly to not be seen a key area of fleet management focus at all times.